The Politics and Economy are Aligned

A survey of tax history, arguments for and against raising taxes, and an exhortation to tax the rich.

Why We Need Taxes

Unless you’re a disciple of Grover Norquist and want to drown government in a bathtub, you might see taxes as necessary for certain community needs like law and order, security, financial regulation, and public services. Provided with the consent of the governed for the common good, these services require payment. Or as Oliver Wendell Holmes Jr. said, “Taxes are what we pay for civilized society.”1

Federal Tax History

The chart below shows Federal revenue by source from 1790 to 2015, based on data from the U.S. Census and St. Louis FED. Before 1913 Federal revenue came mostly from import tariffs and excise taxes, taxes on specific items like cigarettes, beer, and gasoline. After 1913 it changed to mostly individual and corporate income taxes, except during the Great Depression. (The Social Security payroll tax in blue is not general revenue.)2

Taxes on income were intended to shift the overall tax burden to higher income levels by replacing regressive tariffs and excise taxes, which behave like sales taxes. Before the change the wealthy of the Gilded Age (1877-1900) were seen politically as accumulating and even flaunting wealth. If this sounds like the behavior of recent tech bros Elon Musk and Sam Bankman-Fried, you’re right.

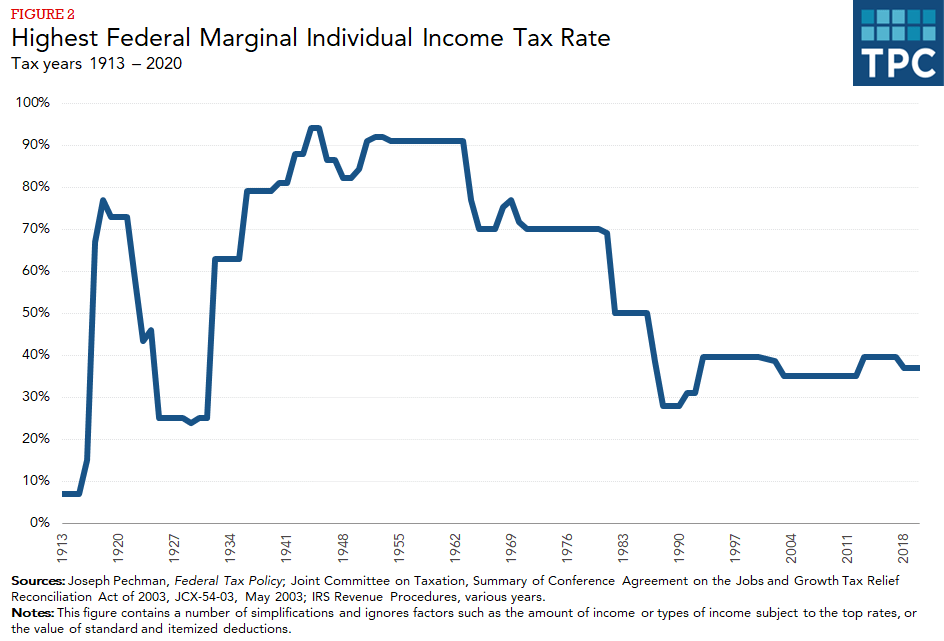

The marginal Federal income tax rate is the amount of additional tax paid on every additional dollar earned. More than a decade ago Berkeley Professor Robert Reich suggested raising the highest marginal rate to 70% on incomes over $15 million, and it was criticized as “pure fantasy”. Reich’s reply was that Republican President Dwight D. Eisenhower (that well known Communist) had a maximum rate of 91%. And between the late 1940s and 1980 the maximum rate averaged above 70%. 3

The Eisenhower post-World War II economy expanded strongly during the 1950s. Unemployment was low and inflation usually 2 percent or less. Although more conservative Republicans pressed for tax cuts, Eisenhower prioritized balancing the budget. Personal income increased by 45%, and many families bought homes and new household items, including televisions and stereos. The poverty rate declined, although one in five Americans still lived in poverty by the end of the decade.4

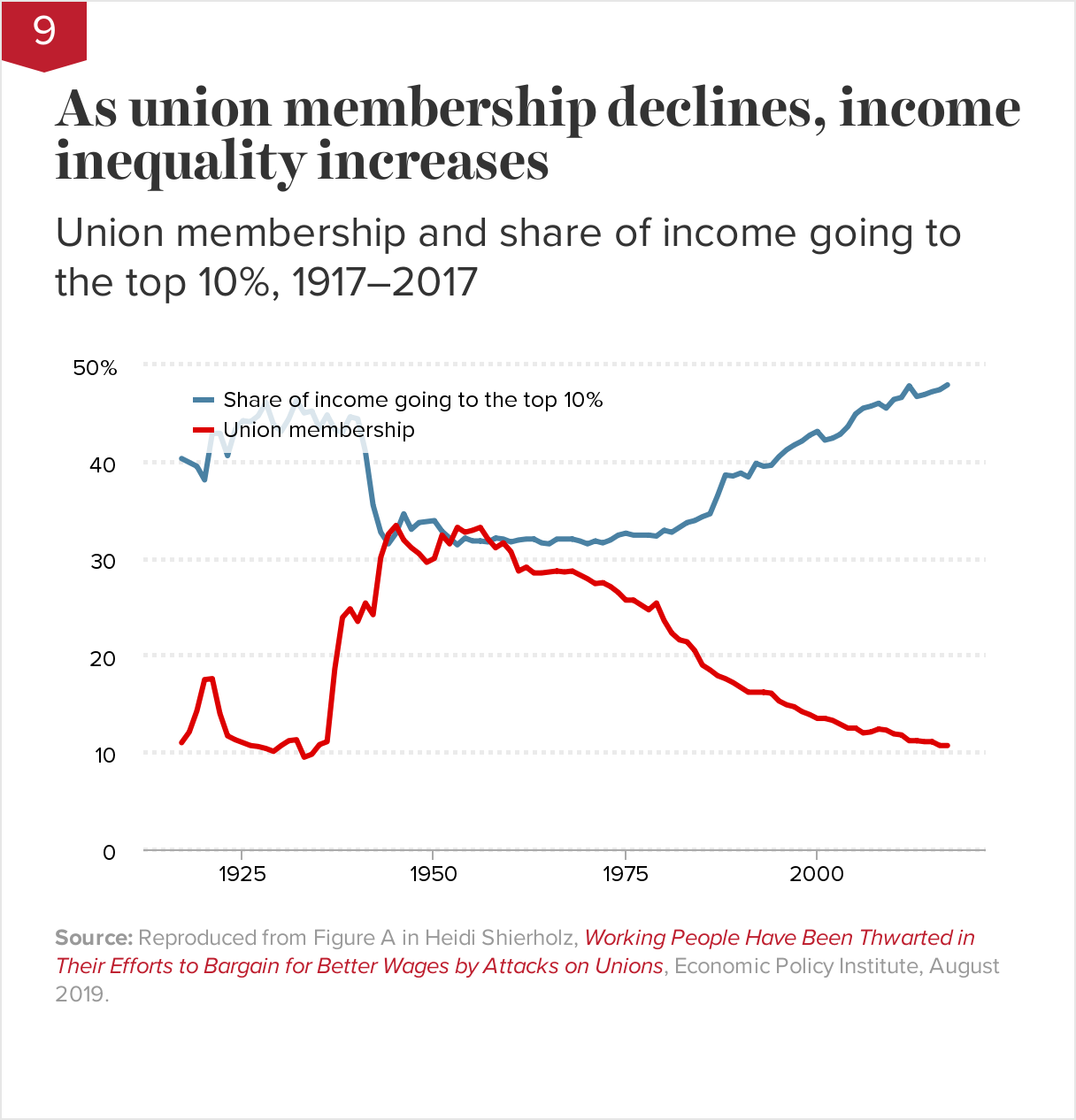

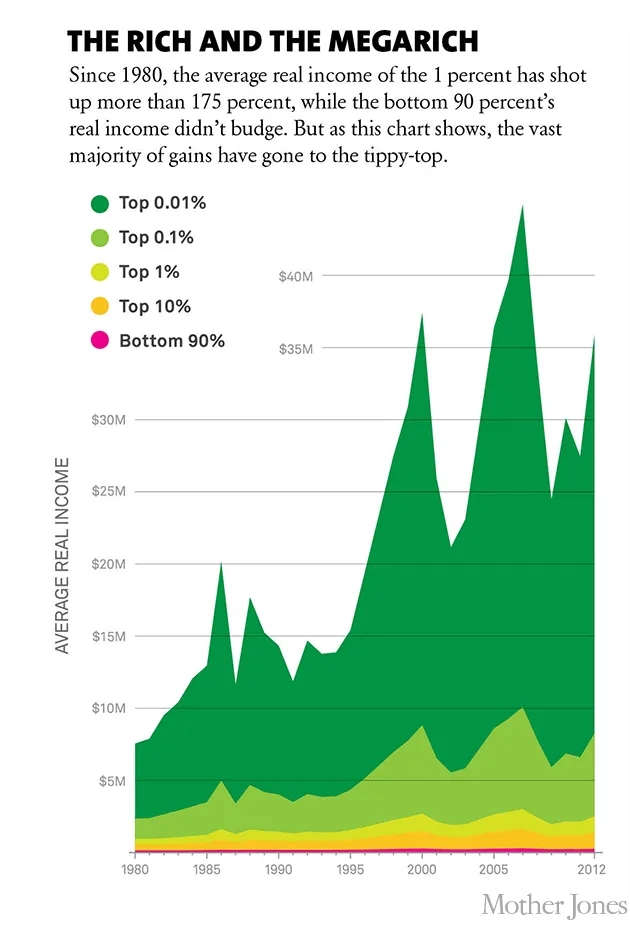

Since the share of total income for the top 1% has doubled from 7% in 1979 to 15% by 2021, the argument for a higher marginal tax should be more realistic now. The Economic Policy Institute has argued that growing inequality is caused by intentional policy decisions, but can be reversed by prioritizing full employment, strengthening and enforcing labor standards, and removing obstacles to worker unions. Another approach would be to tax the rich.5 Like Willie Sutton said, “That’s where the money is.”

Arguments in Favor

Paul Krugman

Nobel-prize winning economist Paul Krugman calls President Biden’s latest budget for Fiscal Year 2024 “sensible,” given the political reality of a split Congress. The budget calls for expanding the social safety net and reducing the deficit by bargaining over Medicare drug prices, raising corporate taxes, and raising the income tax on individuals with annual incomes over $400,000.6 The 2020 Top 5% average income was about $343,000.7

Britain spent large parts of the 19th and 20th centuries with debt above the current U.S. level, but without a severe debt crisis. To hold this current debt to GDP ratio, Krugman wants even more control of the growth of our healthcare costs, the highest of any developed country in the world. But he thinks we’ll also eventually have to raise taxes on people making less than $400,000.8 The 2020 Top 10% average income was about $173,000.9

Krugman also had a recent insight into migrating rich:

The main problem with moving to Florida is that you have to live in Florida. . . Furthermore, decisions by the wealthy about where to live aren’t all that sensitive to tax rates. Indeed, California — where taxes on high incomes are higher than New York’s — is currently seeing rapid growth in the number of taxpayers making more than $1 million, and explosive growth in those making more than $50 million. . . For all the evidence suggests that affordable housing, not low taxes on the rich, is the main driver of growth in the rest of the Sun Belt.10

Warren Buffet

Warren Buffet, chairman and CEO of the insurance firm Berkshire Hathaway, is the 5th richest person in the world. He has also become a famous philanthropist, pledging in 2010 to give away 99% of his fortune.11

In 2006 he compared his federal income tax at 18% of his income to his employees average tax of 33% of their incomes, despite making much less money ($60,000 to $750,000).12 Buffet said, “How can this be fair? How can this be right? There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”13

Buffett also supports taxes on generational wealth, testifying in 2007 to the Senate that the estate tax helps prevent America from becoming a plutocracy.14 Nobel Prize–winning economist Joseph Stiglitz wrote in 2011 that the United States is increasingly ruled by the wealthiest 1%, a government “Of the 1%, by the 1%, for the 1%”, to rephrase the Gettysburg Address.30 The term “plutocracy” has been considered a pejorative throughout history. Plutocrats have been condemned for ignoring social responsibilities, serving their own purposes, increasing poverty and class conflict, and generally corrupting societies.15

UAW President Shawn Fain recently discussed labor negotiations with Ford, GM, and Chrysler, whose CEOs have taken a 40% pay increase over the past four years. Noting the $29 million GM’s CEO received in 2022, he said it would take an entry-level worker at a GM battery plant 16 years to earn as much as that CEO makes in one week.16 In response, CNBC’s Jim Cramer shouted: “That’s class warfare! And it’s very shocking to hear class warfare!”31 Income inequality has increased with declining union membership:

Theodore Roosevelt

Wealthy oligarchs have existed since America began, and may even be a definition of the Founding Fathers.

I regard this contest as one to determine who shall rule this free country — the people through their governmental agents or a few ruthless and domineering men, whose wealth makes them peculiarly formidable, because they hide behind the breastworks of corporate organization.

― Theodore Roosevelt, Address on the occasion of the laying of the corner stone of the Pilgrim memorial monument, August 20, 190717

The material progress and prosperity of a nation are desirable chiefly so long as they lead to the moral and material welfare of all good citizens. . . The absence of effective . . . restraint upon unfair money-getting has tended to create a small class of enormously wealthy and economically powerful men, whose chief object is to hold and increase their power. The prime need is to change the conditions which enable these men to accumulate power which is not for the general welfare that they should hold or exercise . . . The right to regulate the use of wealth in the public interest is universally admitted.

—Theodore Roosevelt, Dedication of the John Brown Memorial Park in Osawatomie, Kansas, August 31, 191018

Arguments Against

Arthur Laffer

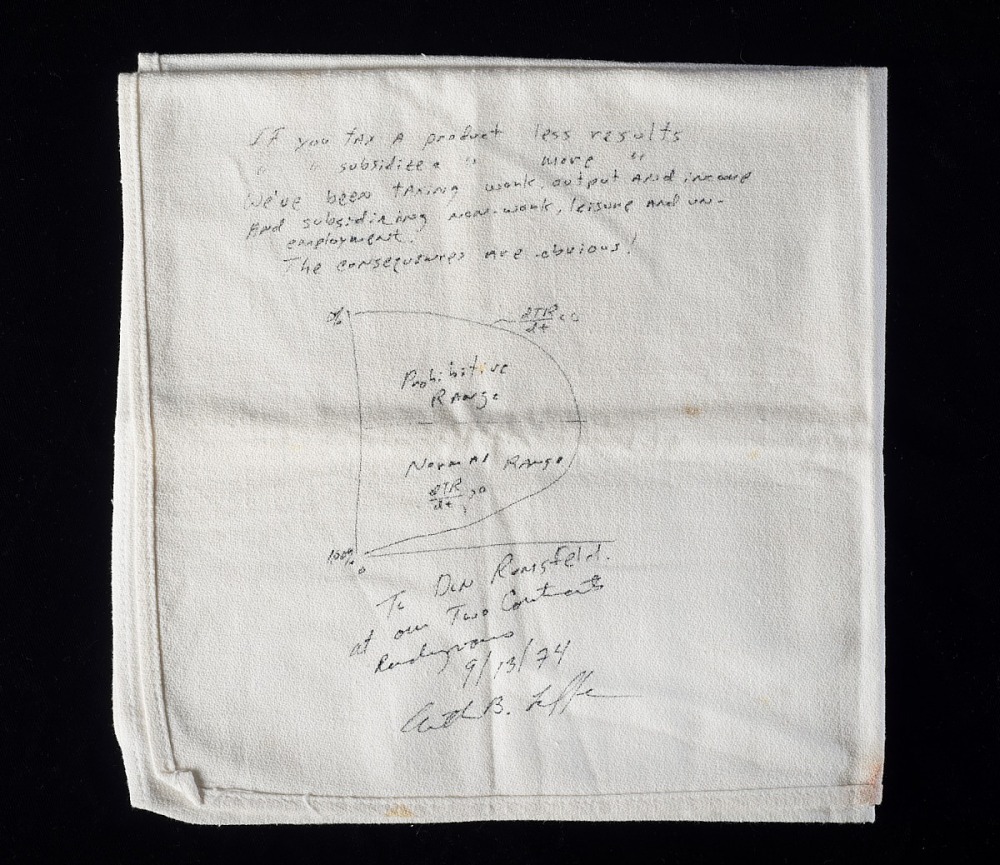

American economist Arthur Laffer developed a bell-curve of tax rates and tax revenue. Laffer argues that taxes could be either too low or too high to produce maximum revenue. If taxes are too low, an increase raises more revenue. If taxes are too high, increasing rates will discourage work and reduce revenue.

Criticisms of the Laffer Curve include

- it’s overly simplistic for multiple tax brackets,

- it provides no actual numbers for rates and revenue, leaving policymakers to guess what works, and

- it makes assumptions about complex individual and business behavior not based solely on tax rates.

The Laffer Curve was put into practice by President Reagan as supply-side and trickle-down economics, and the top marginal tax rate was lowered over his 8 years in office from 73% to 28%. The success claimed was the growth of annual federal tax revenue from $517 billion in 1980 to $909 billion in 1988.19

By other measures it was not successful. From 1980 to 1990 Federal tax revenue actually fell from 18.5 to 17.4% of GDP, the budget deficit increased from $74 billion to $221 billion (2.6% to 2.7% of GDP), the national debt increased from 30.9% to 49.9% of GDP, and median real wages dropped by 0.6%.20 At this point economics seems like a dismal shell game.

Republicans

Republicans have more negative views of income taxes under a Democratic president than Republican. 71% of Republicans now believe their taxes are too high, compared to 46% in 2020 under a Republican president. Democratic opinions haven’t changed, while independents have risen from 48% to 62%, or half the Republican change.21

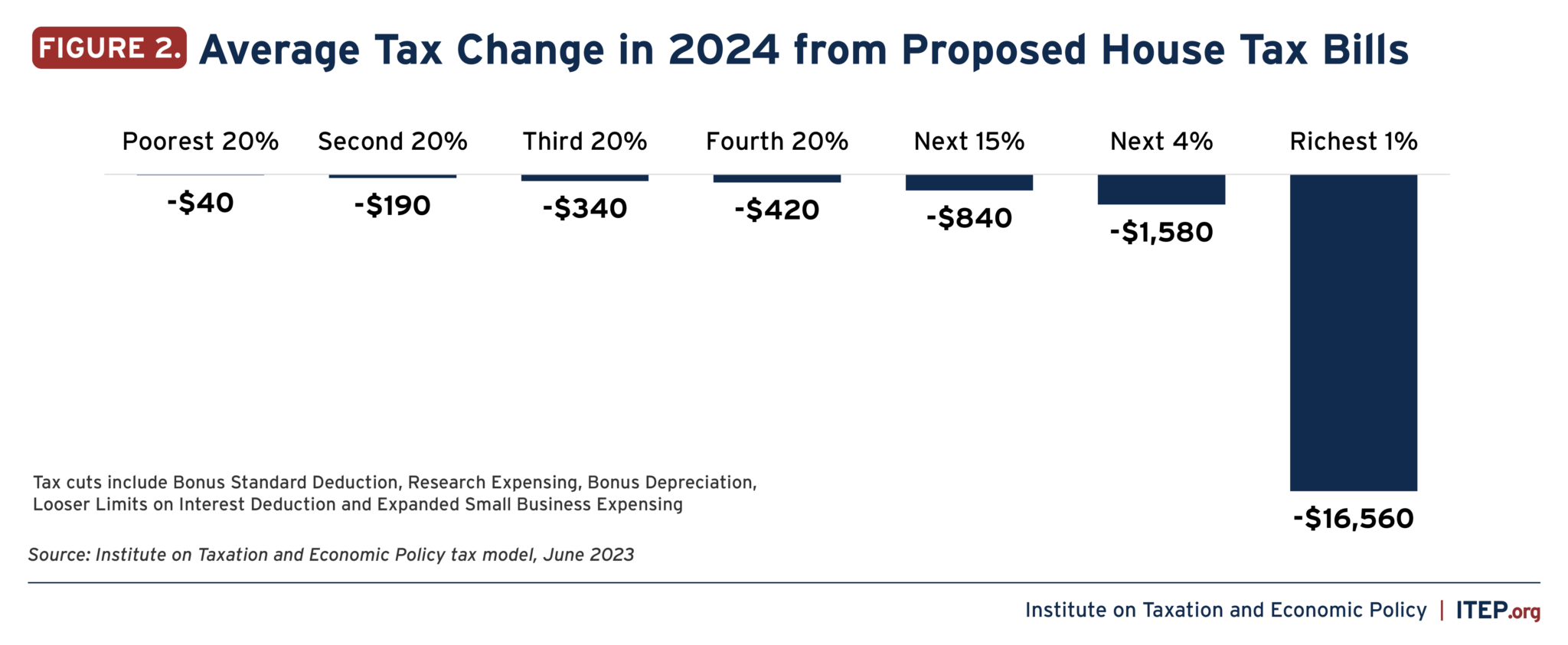

Republican House tax bills proposed in 2023 include tax cuts for mostly the richest 1% of Americans and foreign investors:

The legislation includes an increase in the standard deduction that would help some middle-income taxpayers but not lower-income. The poorest 1/5 of Americans would receive an average tax cut of just $40 next year, while the richest 1% would receive an average $16,560 cut. Revenue-raising provisions would repeal clean energy tax credits and increase climate change.22

Ayn Rand

Ayn Rand (1905-1982) was a Russian-born American known for her fiction and a philosophy called Objectivism. In a collection of essays titled The Virtue of Selfishness Rand wrote that taxation, which she defined as payment for government services, would be voluntary in a “fully free society” and paid by the individuals needing the services. The question of how to implement this principle was an exercise left for the government. She also said a “fully free society” was one with government reduced to its “proper, basic functions,”23 which sounds like Grover Norquist. After cancer surgery and retirement, Rand allowed a social worker employed by her attorney to enroll her in Social Security and Medicare.24

Libertarians

Ayn Rand had a mixed history with Libertarianism. Her novel The Fountainhead promoted individualism and capitalism and is credited with helping birth Libertarianism. But she did not use the term in the book and specifically rejected the label, calling Libertarians “hippies of the right.”

Libertarians hold liberty as their most important value and want to minimize government rules, which also sounds like Norquist. According to polls approximately one in four Americans identify as libertarian.25 The Libertarian Party says “. . . we think that government forcing people to pay taxes is inherently wrong. . . If Americans want to give money to the government for one reason or another, they should be free to do so. If Americans prefer to spend their money on other things, then they should be free to do that also.”26 According to Sen. Rand Paul (R–Ky.) the “most libertarian” members of Congress in 2019 were Rep. Thomas Massie (R–Ky.), Rep. Justin Amash (R–Mich.), and himself.32 All were actually Republican members. There are no Libertarians elected to Federal office, and no reasonable Libertarian tax proposals.

Tax Avoidance

Robert Reich says the rich always have clever accountants and tax attorneys for legal tax avoidance, and will always manage to reduce what they owe. “During the 1950s, when it was 91 percent, they exploited loopholes and deductions that as a practical matter reduced the effective top rate 50 to 60 percent. . . The lesson is government should aim high . . .” Taken ad absurdum the argument of avoidance against tax increases means the wealthy can do whatever they want —“grand larceny, homicide, or plunder”— because they can always avoid responsibility.27 Like Trump on 5th Avenue.

Tax the Rich

Although 60% of Americans say their Federal income taxes are too high,28 a combination of tax cuts for the 90% and increases for the 10% could reverse that.

America has had a progressive tax system for over a century, and Gallup polls in 2022 continue to show public support for this progressive system. The majority would like to see taxes become even more progressive.29 This is because the goal is not an ideological redistribution of wealth, only collecting more from those who can truly afford to pay.

It’s a way to way to reduce the budget deficit, expand essential programs, and fight climate change. It’s what we need to do. And it’s going to require Democratic wins in 2024.

Footnotes

- Compania General de Tabacos v. Collector, 275 U.S. 87 (1927)

- Max Galka, “The History of U.S. Government Spending, Revenue, and Debt (1790-2015), Metrocosm, February 16, 2016

- Robert Reich, ““A super-high tax for the super rich? Wouldn’t be the first time.,” The Christian Science Monitor, February 16, 2011

- Chester J. Pach, Jr., “Dwight D. Eisenhower: Domestic Affairs,” University of Virginia Miller Center, August 28, 2023

- Inae Oh, “The Richest 0.1 Percent Is About To Control More Wealth Than The Bottom 90 Percent,” Mother Jones, November 11, 2014

- Paul Krugman, “Wonking Out: The Future of Taxes,” The New York Times, March 10, 2023

- Lawrence Mishel and Jori Kandra, “Wage inequality continued to increase in 2020,” Economic Policy Institute , December 13, 2021

- Paul Krugman, “Wonking Out: The Future of Taxes,” The New York Times, March 10, 2023

- Lawrence Mishel and Jori Kandra, “Wage inequality continued to increase in 2020,” Economic Policy Institute , December 13, 2021

- Paul Krugman, “What’s The Matter With Miami?” The New York Times, August 3, 2023

- Warren Buffett, The Giving Pledge, 2010

- Matthew Miller, “Me and My Secretary,” Forbes, November 9, 2007

- Ben Stein, “In Class Warfare, Guess Which Class Is Winning,” The New York Times, November 26, 2006

- Kevin Drawbaugh, “Buffett backs estate tax, decries wealth gap,” Reuters, November 14, 2007

- “Plutocracy,” Wikipedia, accessed 8/31/23

- “UAW seeks double-digit pay hikes in Detroit Three auto contract talks,” Reuters, Aug 3, 2023

- Theodore Roosevelt, “Address on the occasion of the laying of the corner stone of the Pilgrim memorial monument“, August 20, 1907, p.49-50

- MEGAN SLACK, “From the Archives: President Teddy Roosevelt’s New Nationalism Speech,” December 6, 2011

- “Laffer curve,” Wikipedia, accessed 8/31/23

- “Reagan tax cuts,” Wikipedia, accessed 8/31/23

- Jeffrey M. Jones, “Americans’ Views Of Federal Income Taxes Worsen,” Gallup, May 19, 2023

- Steve Wamhoff, “Trio Of GOP Tax Bills Would Expand Corporate Tax Breaks While Doing Little For Americans Who Most Need Help,” Institute on Taxation and Economic Policy, June 11, 2023

- Ayn Rand, “Government Financing in a Free Society,” The Virtue of Selfishness, p. 116

- “Ayn Rand,” Wikipedia, accessed 8/31/23

- “Libertarianism in the United States,” Wikipedia, accessed 8/31/23

- “Taxes,” Libertarian Party, accessed 8/31/23

- Robert Reich, ““A super-high tax for the super rich? Wouldn’t be the first time.,” The Christian Science Monitor, February 16, 2011

- Jeffrey M. Jones, “Americans’ Views Of Federal Income Taxes Worsen,” Gallup, May 19, 2023

- Ibid.

- Joseph E. Stiglitz, “Of The 1%, By The 1%, For The 1%,” Vanity Fair, May 2011

- Brad Reed, “‘I find him frightening!’ CNBC’s Jim Cramer flips out over auto worker’s union boss’ ‘class warfare’,” Raw Story, August 3, 2023

- Matt Welch, “Rand Paul, on a Prospective Justin Amash Presidential Run: ‘The Electoral Prospects Don’t Look That Good’,” Reason, 4/26/2019

Reply

You must be logged in to post a comment.