A Savings Model

Instead of using ballpark numbers like 25 times your annual expenses, or 8 times your annual salary, a better approach to estimate retirement savings needed is to use your personal history of income and expenses, adjusted for changes in retirement. You can do this with a program called FIRECalc. This chart shows my actual balance history, predicted balances assuming a constant average return, and the five lowest of 115 cases from FIRECalc.

These calculations guide my retirement planning by

- tracking my portfolio while saving for retirement,

- informing my decision on when to retire, and

- monitoring my savings in retirement for decisions on Roth conversions and starting Social Security.

Instead of average stock market returns, FIRECalc uses past market data to create a sequence of returns for the number of years you specify. The FIRECalc author provides an example of how average returns can underestimate the savings needed.

Program settings include annual spending (including taxes), initial portfolio balance, total years, Social Security, pensions, year to start withdrawals, portfolio contributions, spending models, and lump sum changes in future years. The program begins with your current portfolio balance, subtracts annual expenses adjusted for inflation, and adds investment gains.

This is repeated for the number of years specified, starting in 1871 for the first cycle or case, and continuing until the last case ends with the most recent data available. My final case ran from December 1984 to 2014. All the cases are shown on the default chart, but you can also obtain spreadsheet values for each case.

One caveat: the results depend on future markets being no worse than the Great Depression.

Required Minimum Distributions

Required Minimum Distributions (RMDs) are minimum annual withdrawals required from certain accounts after age 70-1/2. The RMD’s are defined in IRS Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs) and summarized on this IRS FAQ page.

• all employer sponsored retirement plans, including profit-sharing plans, 401(k) plans, 403(b) plans, and 457(b) plans.

• traditional IRAs and IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs.

• Roth 401(k) accounts, which is surprising for a Roth account. This is a reason for rolling a Roth 401(k) to a Roth IRA before RMDs begin.

Technically the deadline to begin is April 1 of the year following the year in which you reach age 70-1/2. Withdrawals of any funds (original deposits or reinvested capital gains or dividends) are all taxed as income and reported to the IRS on Form 1099-R Box 1. There is a 50% excise tax on the amount of required distribution not taken.

You may be able to make an in-kind transfer to a taxable account instead of a cash distribution, if both source and destination accounts permit. You can also make a qualified charitable distributiondirectly to a charity as part of an RMD and exclude it from your income. The trade-off is that the tax-free charitable distribution can’t also be itemized as a charitable deduction.

If you’re still working and contributing to a 401(k) or 403(b) at 70-1/2, you may be able to delay the RMDs until the year that you “separate from service,” if your retirement plan lets you.

Your IRA account provider probably has an RMD calculator and should be able to arrange automatic distributions of your RMD’s. This is Vanguard’s RMD calculator.

401(k) Rollovers

If you have a 401(k) account in an employer plan, the plan rules will determine whether you can continue the account in retirement. Separation of employment is usually required for a withdrawal, but often does not require account termination. Talk to your human resources staff and the 401(k) provider.

I rolled my traditional 401(k) into a traditional IRA on retiring, because I had long felt that the 401(k)’s customer was my employer, and not me. This was confirmed when I attempted to have Vanguard pull my 401(k) from Empower Retirement. I sent Vanguard completed Empower withdrawal and Vanguard deposit forms, but Empower refused the request. Instead, they called my employer (not myself), and insisted on my sending them a withdrawal form directly. I did, and the transfer was made after a month in cash. Transfers-in-kind, where the accounts remain invested in funds while moving between providers, require the permission of both providers and was not available to me. The lesson: pulling funds and transfers-in-kind are optimum, but they require the cooperation of both source and destination providers.

A good summary of the tax consequences of rollovers is the IRS Rollover Chart. It tells you which rollovers are permitted, but the footnotes are key for taxes:

1 “Qualified plans include, for example, profit-sharing, 401(k), money purchase, and defined benefit plans.” A “defined benefit plan” is one that provides a benefit based on a fixed formula, for example, a pension.

3 “Must include in income.” This means the rollover is a taxable event that must be included in your AGI for the tax year.

Other footnotes address more specific time, account, or transfer limits.

My rollover of a traditional 401(k) to a traditional IRA was not a taxable event, but my later Roth conversions were.

Roth Conversions

Another question is whether you want to keep a traditional IRA, or roll some or all into a Roth. There is an opportunity for this if you are delaying Social Security Retirement after you stop working. You can transfer an amount that brings your yearly Adjusted Gross Income (AGI, Form 1040 Line 7) to the upper limit of your current tax bracket, and continue until you start Social Security. This will reduce your RMD’s for the balance of the traditional IRA.

The Roth Conversion is reported to the IRS on Form 1099-R Box 2a. If you have kept your traditional and Roth contributions in separated IRA’s, then that amount can be entered on Form 1040 Line 4b without using Form 8606, Nondeductible IRAs. Form 8606 instructions say “If you received distributions from a traditional, SEP, or SIMPLE IRA in [year] and you have never made nondeductible contributions (including nontaxable amounts you rolled over from a qualified retirement plan) to traditional IRAs, don’t report the distributions on [year] Form 8606.”

Qualified Roth Distributions

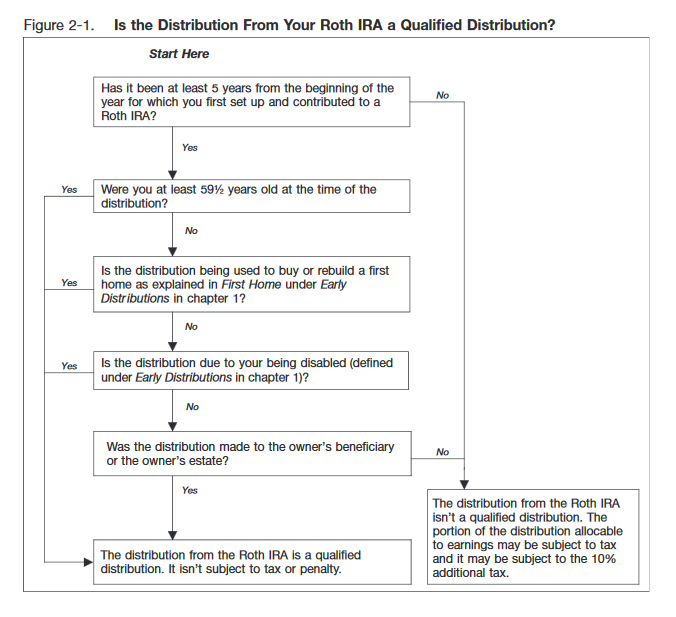

Figure 2-1 in IRS Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs), is the simplest explanation of when a Roth IRA withdrawal is a qualified distribution, free from penalties and taxes on earnings.

There are only two requirements for a typical qualified distribution from a Roth IRA in retirement:

- The owner contributed to any Roth IRA at least 5 tax years before the withdrawal, and

- The owner was at least 59-1/2 years old at the time of the withdrawal.

All other criteria involve exceptions for earlier withdrawals. I refer to the “owner” of the Roth because IRAs are individually owned. There is no “joint” IRA, even if you file a joint return.

If you have a designated Roth account in a 401(k), 403(b) or 457(b) plan, you should read the IRS Designated Roth Accounts – Distributions. The rules seem similar to a Roth IRA, except surprisingly being subject to Required Minimum Distributions (RMDs). If you have or are considering one, you should review this with human resources or your plan provider.

Withdrawals

There are some general recommendations on the order of accounts:

- Take RMDs first.

- Use taxable accounts next, to allow your tax-advantaged accounts to grow. Turn off reinvestment of dividends and capital gains in these accounts to simplify your tax basis.

- Use tax-deferred accounts like traditional IRAs next.

- Finally, use tax-free Roth accounts to keep your marginal tax bracket low. If not used, Roth accounts will also transfer some tax advantages to your estate.

Before retirement I considered transferring some portfolio funds into short-term bond funds, thinking I needed a less volatile buffer between investments and spending money. That turned out to be unnecessary, because your stock/bond split that limits investment volatility also provides stability for withdrawals.

My stock/bond split is currently 60% total stock and 40% total bond index funds, what John Bogle called the “Younger Distribution” phase of a basic asset allocation model. Basic because it had only four phases, from 80/20 to 50/50.1

My withdrawals go from

• Vanguard to Ally Savings, quarterly, and

• Ally Savings to credit union checking, monthly.

Disclaimer

This is my personal experience, and not professional investing advice. For that you should talk to a Certified Financial Planner, preferably for a fixed fee and not a sales commission. Make sure you ask how the advisor gets paid. Does her agreement promise to meet a fiduciary standard?

Footnotes

1 Bogle on Mutual Funds, John Bogle, Dell Publishing, New York, 1994, pg. 238.

Reply

You must be logged in to post a comment.