The Time Value of Money

I spent more than half my working life saving in whatever guaranteed pension plan my employer offered, but a change to a 401(k) plan finally forced me into making my own investment decisions.

My Portfolio

After a lot of reading and some false starts, I retired with these assets:

- A mix of no-load index mutual funds (total U.S. stock, total international stock, and total U.S. bonds) in a

- A pre-tax traditional 401(k).

- A home.

- Eventually, Social Security after waiting until 70.

The index fund portfolio is low-cost, low-maintenance, broadly diversified, and guaranteed not to beat, but only own, the stock market. The rest of the secret is saving as much as you can, compound interest, and time. So start now.

The Time Value of Money

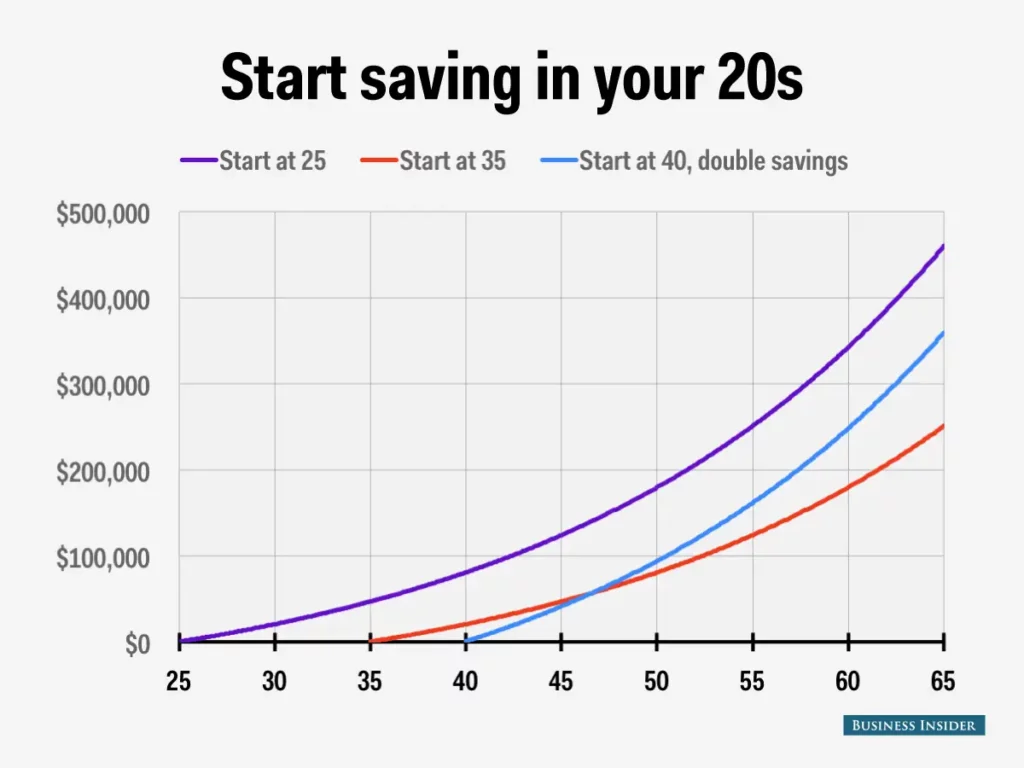

The chart shows three investors taking different approaches to retirement saving:

- The first (purple) starts at 25 and saves $300 per month.

- The second (red) waits until 35 and saves $300 per month.

- The third (blue) waits until 40 and saves $600 per month to catch up.

The results at 65 are for “a respectable but reasonably conservative annual rate of return of 5%.”1 You can calculate your own totals with this investment calculator.

Since returns are guaranteed by “time in the market, not timing the market,” you have to buy and hold the funds. Not only don’t day trade, but don’t sell over your entire working life. Now you see why you have to own the entire market, and not pick and choose.

A Mix of Stock and Bond Funds

How you mix your funds between stocks and bonds usually changes with age and investing horizon. How many more years of income will you have? How long will it take to recover from expected market downturns? How comfortable are you with decreasing balances? It’s very subjective and the subject of many questionnaires. Too many bonds, and you take too long to reach the necessary savings. Too many stocks, and you can’t recover.

Bonds smooth out more volatile stock losses. This growth of $10,000 chart shows what happened between 2007 and 2017:

The blue curve is the total U.S. stock index and the orange is the total U.S. bond. Your % bonds determines how much you lost in the 2008 “Great Recession”, and how much you’ve gained since. I know what you’re thinking, but anyone who tries to buy and sell to time these changes ends up losing. No one knows what the chart will look like tomorrrow.

Resources

The biggest false start I can remember was thinking that if I just did my homework, my “due diligence” as they say in finance and law, then I could pick the best funds offered by my 401(k). What you learn eventually is that all best fund recommendations change quickly, because financial writers look at short time frames for performance, and sometimes change selection criteria. How else can you keep selling articles?

If you want more details (and you should), you should read the free article “If You Can, How Millennials Can Get Rich Slowly” by William J. Bernstein.2 Another good source on investing is the Bogleheads Wiki, inspired by Vanguard founder John Bogle. Participate on the Forum if you’re interested in discussion or have questions, but spend some time mastering the basics in the Wiki first.

Other good sources that I came across earlier were Andrew Tobias’s The Only Investment Guide You’ll Ever Need, helpful and fun to read, and Paul B. Farrell’s Lazy Portfolios.

Too much information can sometimes create indecision and gridlock, but delay is deadly, and better is the enemy of good. You don’t need to know the perfect mix, or every detail of how the market works, to successfully buy and hold mutual funds. Someone once said, “When I ask what time it is, I don’t need to know how a clock works.” Which is ironic, because my children accuse me of wanting to tell them about the clock.

Disclaimer

This is my personal experience, and not professional investing advice. For that you should talk to a Certified Financial Planner, preferably for a fixed fee and not a sales commission. Make sure you ask how the advisor gets paid. Does her agreement promise to meet a fiduciary standard?

Footnotes

- Andy Kiersz, “Actually, young people SHOULD invest in their 401(k) plans,” Business Insider, Apr 22, 2015 ↩︎

- William J. Bernstein, “If You Can,” 2014 ↩︎

Reply

You must be logged in to post a comment.